Newpro Home Improvement Solutions: Financing Plans for 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the details of Newpro's financing options for 2025, a world of possibilities opens up for those seeking to embark on home improvement projects with ease and flexibility.

Overview of Newpro Home Improvement Solutions

Newpro Home Improvement Solutions is a reputable company with a rich history of providing high-quality home improvement services to customers. Established in 1945, Newpro has built a strong reputation for excellence and customer satisfaction over the years.

The range of services offered by Newpro includes but is not limited to window and door installations, siding replacement, bathroom remodeling, and kitchen renovations. With a team of skilled professionals, Newpro ensures that every project is completed with precision and attention to detail.

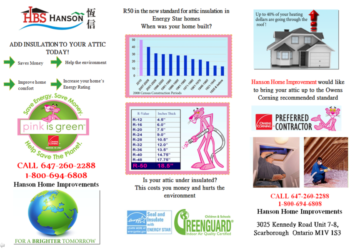

Financing plans play a crucial role in making home improvement projects more accessible to homeowners. By offering flexible financing options, Newpro allows customers to embark on renovations and upgrades without having to worry about the financial burden all at once.

This enables homeowners to enhance the value and comfort of their homes while managing their budget effectively.

Financing Options Available in 2025

When it comes to financing your home improvement projects, Newpro Home Improvement Solutions offers a variety of options tailored to meet your needs. Let's take a closer look at the different financing plans available for 2025.

Financing Plans Overview

Here is an overview of the financing plans offered by Newpro Home Improvement Solutions for 2025:

- 1. Standard Financing Plan: This plan offers competitive interest rates and flexible repayment terms, making it a popular choice for many customers.

- 2. Zero-Interest Financing: For those looking to avoid paying interest, this plan allows you to spread out your payments without incurring any additional costs.

- 3. Low-Interest Financing: This plan offers a lower interest rate compared to the standard plan, providing savings for customers who qualify.

Interest Rate Comparison

Here is a comparison of the interest rates for each financing option:

| Financing Plan | Interest Rate |

|---|---|

| Standard Financing Plan | 5.99% |

| Zero-Interest Financing | 0% |

| Low-Interest Financing | 3.99% |

Eligibility Criteria

To qualify for Newpro Home Improvement Solutions' financing plans, customers must meet certain eligibility criteria, which may include:

- - Minimum credit score requirements

- - Proof of income and employment

- - Debt-to-income ratio considerations

- - Residential status and ownership

Benefits of Choosing Newpro’s Financing Plans

When it comes to financing your home improvement projects, opting for Newpro's financing plans can offer several advantages over other alternatives. From flexible payment options to competitive interest rates, here are some of the benefits of choosing Newpro:

Examples of Successful Home Improvement Projects

- Upgrading to energy-efficient windows to reduce utility bills and increase home value.

- Renovating a kitchen or bathroom to enhance the overall look and functionality of the space.

- Adding a deck or patio for outdoor entertainment and relaxation.

How Newpro’s Financing Plans Help Achieve Renovation Goals

- Customized financing options tailored to fit your budget and timeline.

- Access to professional installation services to ensure quality workmanship.

- Potential increase in home value and curb appeal with completed renovation projects.

Customer Testimonials and Reviews

Customer testimonials play a crucial role in showcasing the positive experiences of individuals who have utilized Newpro's financing plans. These firsthand accounts provide potential customers with insight into the seamless process and benefits of choosing Newpro for their home improvement projects.

Impact of Positive Reviews

- Positive reviews act as social proof, instilling trust and confidence in prospective customers who may be hesitant about committing to a financing plan.

- Word-of-mouth recommendations based on satisfied customers' experiences can significantly influence new clients to choose Newpro over competitors.

- Online reviews and ratings contribute to the overall reputation of Newpro, attracting a wider audience seeking reliable and reputable financing solutions.

Customer Feedback Influence

- Customer feedback is closely monitored and analyzed by Newpro to identify areas of improvement in their financing options.

- Insights from customer reviews help Newpro tailor their plans to better meet the needs and expectations of homeowners, ensuring a more personalized and satisfactory experience.

- Feedback regarding interest rates, repayment terms, and customer service has led to the enhancement and evolution of Newpro's financing options, making them more competitive and customer-centric.

Summary

In conclusion, Newpro's tailored financing plans for 2025 pave the way for homeowners to realize their renovation dreams with confidence and financial ease, marking a significant step towards enhancing living spaces and lifestyles.

FAQ Corner

What are the different financing plans offered by Newpro for 2025?

Newpro offers a range of financing options such as low-interest loans, flexible payment plans, and zero-down payment schemes to cater to diverse financial needs.

How do Newpro's financing plans differ from other alternatives?

Newpro's financing plans stand out due to their competitive interest rates, customer-centric approach, and hassle-free application process, making them a preferred choice for many homeowners.

Can customers with less-than-perfect credit qualify for Newpro's financing plans?

Yes, Newpro offers financing options for customers with varying credit profiles, ensuring accessibility and inclusivity for individuals looking to undertake home improvement projects.